Why Instaclustr is an Australian tech company to watch

Instaclustr raised $15.7m USD ($21m AUD) during August 2018 in a Series B round led by New York-based growth equity fund Level Equity. Existing investors Our Innovation Fund, LP and ANU-Connect Ventures also invested in the round alongside Level Equity.

Instaclustr is a world leading open source data platform for cloud based solutions that require immense scale. It is ideally positioned to take advantage of the growth of ‘big data’ applications, servicing a large and growing global addressable market.

The performance of Instaclustr has been a recent highlight for the BTI portfolio. The Canberra-based company now has more than 100 customers from a wide range of industries across the globe, and revenues have grown 300% over the last 24 months. Attracting a high calibre US investor such as Level Equity is a testament to the progress Instaclustr has made since Bailador’s investment less than two years ago.

The funding provides Instaclustr with capital to accelerate the global expansion of its managed platform, grow its sales and support team, and allow the company to reach more organisations that are seeking to optimise their data-related performance. Instaclustr will double its headcount over the next year, with significant expansion planned for the engineering and development teams based in Australia.

We believe this current funding round is the beginning of another exciting phase for Instaclustr, and that the company has a bright future as it continues to capitalise on the growth in big data, cloud computing and open source software.

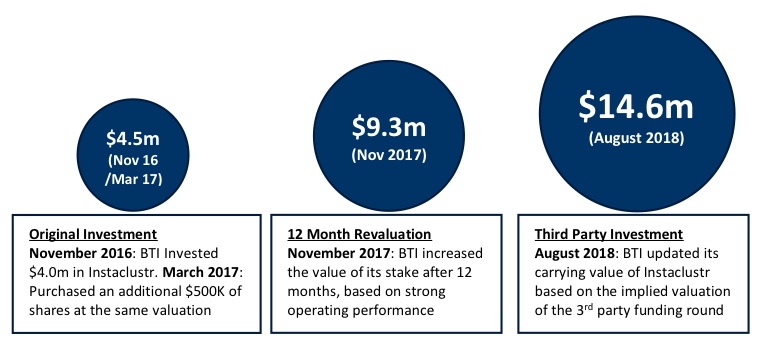

BTI’s carrying value of Instaclustr over time

Bailador’s Investment Philosophy: Instaclustr as a Case Study

The investment in Instaclustr is a good example of Bailador’s investing philosophy and the characteristics that we look for in a potential portfolio company.

Proven & Founder-led management team: Instaclustr’s management team are exceptional, and all the original founders are still running the business today. The two technical co-founders (Ben and Adam) have spent years working in tech and are now considered thought leaders in the open source technology space. The other two co-founders (Doug and Pete) are seasoned entrepreneurs who had already run and sold a company prior to founding Instaclustr. Other members of the management had prior experience at large companies such as IBM and Accenture.

Revenue traction and established product market fit: At the time of investment, Instaclustr had been operating for three years and already had a few million dollars in revenue. A number of large companies were paying for their product, and many of them came inbound to Instaclustr looking for a solution, demonstrating market demand for the product. Through our numerous customer diligence calls it was clear that users loved the product and the quality of service they received from Instaclustr. Data showing Instaclustr customers growing their usage overtime gave us additional comfort that they had found product-market fit and that customers would continue to use the product in the future.

Proven business model with attractive unit economics: Not only was Instaclustr rapidly growing its revenue, but the quality of this revenue was high — the majority of the revenue was recurring subscriptions with high gross margins. They also had very high customer retention numbers and strong customer account expansions — this is where customers would sign on for a specific monthly amount and then increase their spend over time as they used the service more. They were also able to acquire customers efficiently through a large number of inbound requests along with the low-touch sign up process they developed. All of the above characteristics and data points gave us confidence that the company could scale profitably over time.

International revenue generation: Most of Instaclustr’s staff are based in Canberra, but the majority of their revenue came from outside of Australia and this continues to be true.

Huge market opportunity and favourable market trends: Instaclustr is addressing the multi-billion-dollar global database market through their Apache Cassandra offering. As they continue to add support for additional products such as Apache Kafka and Apache Spark, they have increased the size of their addressable market. Instaclustr is also taking advantage of a number of trends such as the growth in big data, companies migrating their databases to the cloud and the growing adoption of open source software.

BTI value add: Since Bailador first invested in Instaclustr we have played a hands-on role in supporting the company when needed. We’ve been able to assist the management team with analysis, strategic thinking, hiring and fundraising.

A version of this article first appeared in the BTI Investor Update for August 2018.