Straker Translations and listing on the ASX

On the 22nd October 2018, BTI portfolio company Straker Translations listed successfully on the ASX, raising A$21m. As one of the only VC-backed Australian technology IPO’s for 2018, this was a huge success for the BTI portfolio.

The Straker IPO is an excellent example of how BTI provides access for Australian and New Zealand investors to high growth technology businesses at an attractive valuation before they become publicly traded.

Bailador’s Investment Philosophy: Straker as a Case Study

Bailador identified that the Straker business provided a unique opportunity to invest expansion capital into an established high quality technology company growing in a global market. Bailador first invested in August 2015 and further supported the business in October 2016. There are several characteristics of the Straker business model that we are attracted to as expansion stage investors and continue to make the business an exciting investment today.

Huge market opportunity and favourable market trends: The global market for language services was estimated at US$43 billion in 2017 and is expected to grow at an estimated CAGR of over 9% up until 2022 to US$67 billion. The expansion is driven by increasing levels of globalisation, the rapid increase in online and offline content production, the growth in eCommerce and the emergence of new markets with specific language requirements and European regulatory requirements.

Global revenue traction and established product market fit: At the time of investment, Straker had been operating their business model for five years and already had over $5m in annual revenue. They had attracted a number of large global customers and the team was looking to expand their sales operations in Europe and the US. Today, Straker is forecast to achieve over $23m in revenue this financial year, has a team of 120 people servicing over 8,400 customers, with 88% of revenue generated outside Australia and New Zealand. Their global sales team of 16 is based across seven countries.

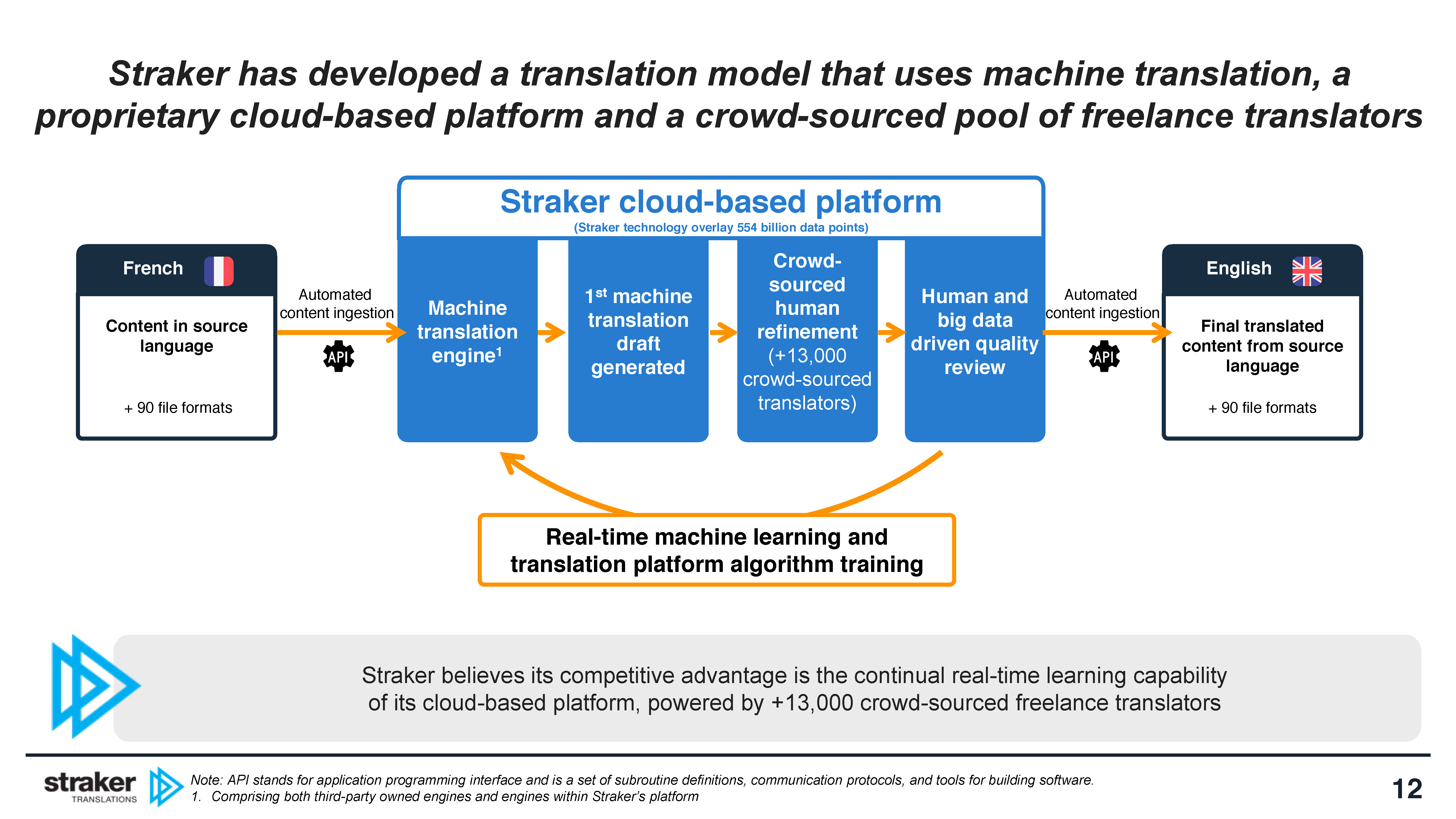

Industry-leading business model: The Straker Ray platform provides the automation and scalability that enables Straker to deliver higher gross margins than most industry competitors. Even better, this is an advantage that continues to develop — as Straker’s data set of translated word pairs increases, their machine translation capability becomes faster and more accurate. This means the platform becomes more efficient because they pay translators by the hour and charge customers by the number of words translated.

Compelling growth strategy: The speed and quality of the work produced by the hybrid translation model has ensured that Straker has the ability to acquire new customers organically. Furthermore, the fragmented nature of the translation industry allows Straker to cost-effectively acquire other translation companies and utilise its superior technology to improve the acquired business’ operating margins.

High quality, founder-led team: Straker is run by the original founders, Grant & Merryn Straker, who have built the technology platform over eight years and continue to operate as CEO and COO today. The company has an exceptional employee retention rate, which is a testament to the culture the Strakers have built in their pursuit of global success from Auckland.

BTI value add: As an investment team, we seek out opportunities where we can provide hands-on support over the lifetime of the investment. We have been privileged to spend the past three years working with the Straker team as they scale the business on a global stage. We look forward to continuing this relationship with Straker well into the future.

Please note: BTI’s carrying value of Straker over time is on an actual currency basis.

A version of this article first appeared in the BTI Investor Update for October 2018.