Stockhead: Bailador delivers solid FY24 return, notes significant valuation upside in portfolio

Bailador Technology Investments delivers solid 8.5% portfolio return for FY24

• Returns driven by public company investments whilst valuation of private company investments remained conservative

• Significant deployment of cash into new portfolio investments (Updoc and DASH), plus follow-on investments

• Private company investments in good shape with strong FY24 growth and significant valuation upside

Special Report: Tech-centric capital fund Bailador Technology Investments (ASX:BTI) has reported a post-tax NTA per share return of 8.5% after all fees and expenses.

The growth capital fund provides exposure to a portfolio of information technology companies with global addressable markets, investing in businesses seeking growth-stage investments that have a proven business model with attractive KPIs, the ability to generate repeat revenue, and in particular international revenue.

Co-founders David Kirk and Paul Wilson noted the solid FY24 return was driven by their public company investments – led by global accommodation channel manager platform SiteMinder which performed very well – whilst overall their private company investments were kept at conservative valuations.

Public company investments lead the way

SiteMinder continued its record of strong revenue growth and achieved milestones including the launch of new products Dynamic Revenue Plus and Channels Plus, winning five categories in the Hotel Tech Awards 2024 and inclusion in the ASX200.

“Our investment in SiteMinder increased in value by $36 million in the year, a lift of 74%,” Kirk said.

Kirk noted BTI’s other public company investment, Straker (formerly Straker Translations), delivered record cashflow and profitability in FY24 and an adjusted EBITDA of NZ$4.5 million for the year.

“Straker’s valuation trod water in FY24 but the business made exciting progress in its product suite and go-to market approach, which we expect to provide positive results in the current year and beyond,” Kirk noted.

During the year, Straker accelerated its use of AI integration in its Language Cloud solution, completed a significant share buy-back and welcomed highly regarded Linda Jenkinson as the new chair.

Private investments in good shape

While private company investments performed well during the year as businesses, they didn’t contribute materially to growth in the value of the fund, delivering an internal rate of return of 2.3% compared to 36.3% last financial year.

“We do not expect this low return to be repeated in FY25,” Kirk said.

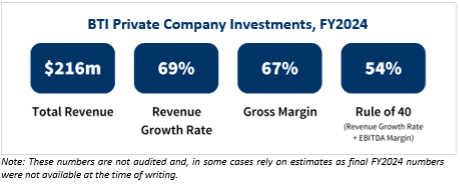

Kirk pointed out the strong operating performance of the private companies as highlighted in the below table:

Kirk also noted the low FY24 return was partly due to the timing of the sale of InstantScripts, which occurred in June 2023, resulting in a very strong valuation uplift just prior to entering the FY24 period.

“Of our other private companies, Access Telehealth and Rosterfy delivered strong valuation uplifts, RC TopCo was held flat despite good progress in the business, and Nosto was marked down,” Kirk said.

“Our long-term view of Nosto’s prospects is unchanged, but the company is exposed to the consumer spending cycle and, as for many companies in the consumer discretionary space, revenue growth was challenged in FY24.”

Significant deployment of cash with new private company investments secured

BTI made two new investments at the back-end of FY24, including $20 million in Updoc in May and $15 million, with a further $5 million to follow, in DASH in June.

“Having been very selective with new investments, holding higher than usual levels of cash for some time, we are very pleased to have made two new high-quality investments recently,” Kirk said.

BTI also made two follow-on investments in portfolio companies Access Telehealth and RC TopCo in FY24.

As a result, the overall cash balance in BTI decreased from a peak of $108m in July 2023 to $62m in June 2024.

“The new investments take the total number of companies in the portfolio to nine. We continue to look for additional investments and are excited by the quality of the deal flow we have seen in the last six months. We expect to make more investments in coming months,” Kirk said.

Upside potential for FY25

BTI says the private company portfolio is in very good shape, and they expect strong growth in FY25, with the portfolio positioned well to surprise on the upside when realised for cash.

“We feel comfortable that we are holding our portfolio of private investments at conservative valuations, and that our public company positions are well understood, providing significant upside potential,” Wilson said.

“We look forward to delivering strong investment returns to investors in the year ahead.”