Television networks reliant on SMI’s big data

By Boon Yap via www.fiercecable.com

Industry Voices—Yap: Upfronts in a big data world

Industry Voices—Yap: Upfronts in a big data world

In the last six years, television networks have had to scramble to keep up with technology, new content distribution models and platforms, and changes in consumer behavior such as scheduling, viewing, time-shifting, viewer engagement, and the well-worn path to purchase. The rise of digital, social, cross-media measurement travails, data-driven targeting, automated buying, and a whole slew of changes have further contributed toward this existential turmoil.

The regimented, old-school applecart of television activation has been upset, though hard to discern, based on the continuation of the hallowed traditional Upfront week. The Upfronts are now preceded by a host of Newfronts led by a colorful, mind-boggling plethora of publishers and platforms (AOL, Conde Nast Entertainment, Refinery 27, Spectrum Reach, Google/YouTube, Hulu, PopSugar, and Vice, just to name a few).

As networks evolve, we can anticipate more advertising spend being allocated to creative media solutions in the form of unified-targeting deals and new measurement solutions such as C7, cross-media metrics, and results-based solutions. The flood of experimental digital activations which seem to materialize daily—the NFL on Amazon; skinny bundles via YouTube TV and Hulu’s Live TV; Snapchat’s network-produced, short-form video; and most critically, the nascent Facebook TV with its rumored two dozen television-style shows targeted natively and contextually—are going to start splitting the traditional TV ad spend even more than “traditional” digital did.

The old aphorism that “content is king” has never been more evident. At sufficient scale, these new delivery mechanisms could have profound implications for targeting, measurement, interactivity, and transactional metrics.

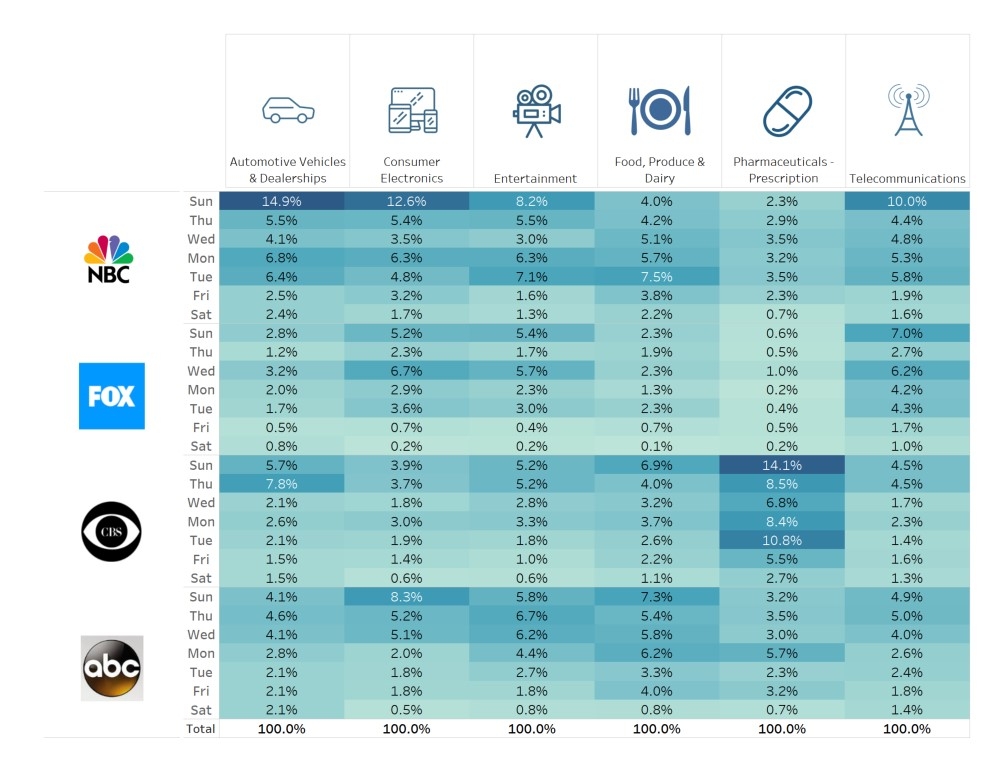

These benchmarks would complement the legacy networks’ data-driven solutions. For example, NBCU has spent billions on its Audience Studio, a data-management platform and “one-stop-shop” TV and digital targeting solution. Not to be outdone, Accenture, Fox, Viacom and Turner have created the OpenAP consortium, helping advertisers devise and verify a standard definition of various consumer segments on TV, employing Turner’s taxonomy.

These benchmarks would complement the legacy networks’ data-driven solutions. For example, NBCU has spent billions on its Audience Studio, a data-management platform and “one-stop-shop” TV and digital targeting solution. Not to be outdone, Accenture, Fox, Viacom and Turner have created the OpenAP consortium, helping advertisers devise and verify a standard definition of various consumer segments on TV, employing Turner’s taxonomy.

Similarly, cable networks will have to reinvent themselves due to viewership, distribution, and market pressures from skinny bundles and cord cutters. Niche cable networks will be increasingly vulnerable in the coming years. Cable networks like Cloo, Esquire, Pivot and Al Jazeera America have turned off their lights, or switched to alternative distribution models. Other cable nets are rebranding themselves or changing their focus, such as Oxygen, which is switching to a crime format, and Spike TV, which rebranded as Paramount.

It is not inconceivable that fewer cable networks may someday survive, as audiences migrate further online. We now live in an age in which audiences watch shows, not networks, and have been schooled in the art of instant gratification, courtesy of Netflix. Audiences Google for information and search for content; scheduled programming has become passé, save for less desirable (to advertisers), less tech-savvy audiences.

Despite an unexpectedly softer 2017 year-to-date scatter market, and the possible threat of a WGA strike, networks remain determinedly optimistic in their Upfront posturing.

Beyond the proliferation of data, we’re continuing to see some cyclical trends resurface, begging the question, are we actually changing as much as it seems?

Year-round original programming

The adoption of lighter, escapist fare such as ABC’s “Start-Up” and “Charlie Foxtrot”; CBS’s “Big Bang Theory” spinoff, “Sheldon”; NBC’s “SNL” alums’ “The Sackett Sisters” and “Great News”; and FOX’s “Orville”

The inevitable resurrection of old series (albeit with a new twist) like CW’s “Dynasty,” CBS’s “SWAT,” and ABC’s just-announced revival of “American Idol,” as well as TLC’s “Trading Spaces”

With so many questions surrounding entertainment programming, sports programming, with its preponderance of loyal, live-viewing male audiences, will continue to play an even more critical role. NBCU will be broadcasting both the 2018 Winter Olympics and Super Bowl LII. Fox has already announced its focus on sports, spotlighting The Big Ten Conference, World Series and FIFA Men’s World Cup. The FIFA World Cup will also be broadcast by Telemundo for the first time after wresting the rights away from longtime broadcaster Univision.

There will be several immutable truths this Upfront: Sellers will sell, buyers will buy, and limited transformational practices will be introduced, despite all the hyperbole. Change comes slowly in the television world, which is why understanding the past might be more fruitful than focusing on the “new.”