Stockhead: Tech fund Bailador backs its conservative valuation model

- Bailador said shareholders can have confidence in its conservative approach to valuing portfolio companies

- Track record of third-party valuation uplifts and cash realisations above carrying value

- Bailador exited Instaclustr with 87% uplift on prior carrying value with strong exits from other portfolio companies

Special Report: Tech-centric capital fund Bailador Technology Investments has emphasised shareholders can have confidence in the valuations of its portfolio, with a consistent track record of third-party valuation uplifts, and cash realisations above carrying value.

Bailador Technology Investments (ASX:BTI) noted that a key principle of its investment philosophy is applying conservative valuations to the portfolio companies that make up its net tangible assets (NTA).

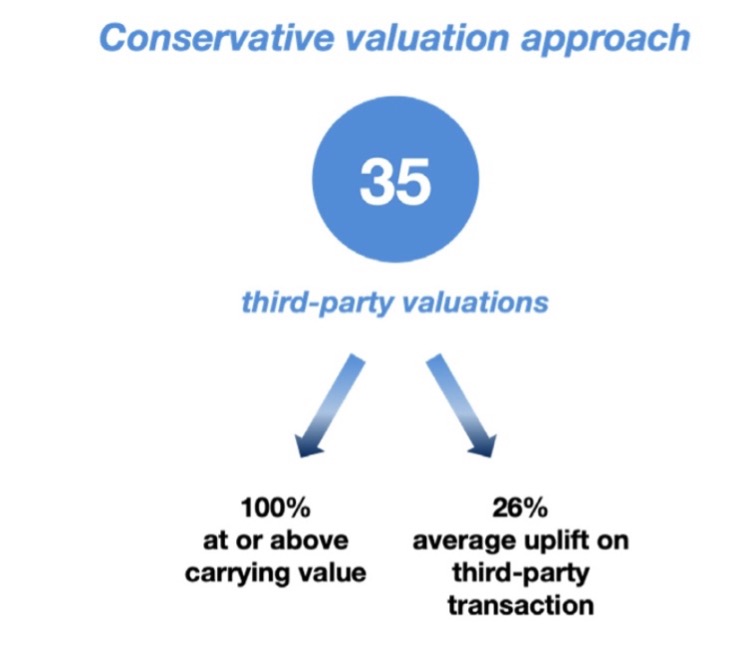

Bailador co-founder Paul Wilson said there have been 35 independent third-party transactions in its portfolio companies.

“Every single time, the valuation of the transaction has been at or above the Bailador carrying value,” Wilson said.

“Some were flat, and some were well in excess of 50% up, but on average the uplift to meet the third-party valuation has been 26%.”

Source: Bailador Technology Investments

The founders said Bailador had executed 13 full or partial cash realisations of portfolio company investments.

“All 13 cash realisations were above the value Bailador was holding the investment at immediately prior to the realisation,” Wilson said.

“The average uplift to our carrying value has been 39%.

“Bailador clearly has a well-proven track record of conservatively valuing our investments.”

Source: Bailador Technology Investments

Valuation policy designed to give shareholders confidence of exit

The founders said Bailador’s conservative valuation policy was designed to give shareholders confidence that, on exit, there would be upside.

When determining valuations internally, Wilson said its valuation principles include:

- Benchmarking portfolio companies against global valuation benchmarks

- Constantly evaluating industry and sector drivers

- Applying a critical lens to the underlying drivers of valuation multiples

- Closely working with and understanding the businesses Bailador invest in, so they are experts on their value

Bailador exits Instaclustr with 87% uplift on previous valuation

The founders said its investment in Instaclustr, a leader in deploying, managing and monitoring data infrastructure was a “standout success story” for Bailador, which exited the investment in May 2022, delivering:

- 87% uplift on the prior carrying value

- $118 million cash realisation

- 80% internal rate of return (IRR)

Wilson said over the life of Bailador’s investment in Instaclustr the valuation was written up eight times including five times via internal benchmarked valuation uplifts, twice following a third-party transaction and again on exit.

“The two third-party transactions were recorded at 58% and 10% respectively above our prior carrying values,” the founders said.

What the doctor prescribed for DocsCorp and InstantScripts

Similarly, the founder said DocsCorp, a developer of desktop and cloud-based document software solutions, was another example of Bailador’s conservative valuation approach.

“Following our initial investment in DocsCorp, there were no third-party transactions until the full cash realisation and exit of the investment,” Wilson said.

“Over the life of the investment, we increased the value of DocsCorp three times via internal valuations and then exited DocsCorp at a valuation 55% above the prior carrying value at an IRR of 30%.”

Bailador was an early investor in telehealth and online prescription services pioneer InstantScripts, which garnered strong consumer demand and was acquired by Wesfarmers (ASX:WES) in June 2023.

“Over the life of our investment in InstantScripts, there were a number of third-party transactions where Bailador marked our investment to the latest third-party transaction value,” Wilson said.

“Each transaction was a valuation higher than the previous transaction with the final cash realisation 25% above the previous carrying value and at an IRR of 62%.”

Confidence for investors

The founders said Bailador’s successful exits from portfolio companies demonstrated that the fund knows its businesses well and how to value them conservatively so shareholders can have confidence that their valuations can be trusted and hold real potential for upside.

“The well-established track record of realising investments at higher than carrying value can give investors confidence that the NTA published by Bailador should be met or exceeded,” Wilson said.