Stockhead: Travel is back and Bailador reckons it’s in prime position for future strong growth

If you think travel is booming now, Bailador says you just wait until you see what’s round the corner.

Tech-focused growth capital fund Bailador Technology Investments (ASX:BTI) reckons the travel sector is a card worth holding, showing signs of a strong recovery from the COVID-19 pandemic.

BTI has a long track record of investing in the travel sector and was an early investor in global hotel commerce platform and tech unicorn SiteMinder (ASX:SDR), deploying $5 million in when it had annual revenue of ~$5 million.

BTI partner Bevin Shields said while the sector was heavily impacted by the COVID-19 pandemic and lockdowns globally, it has experienced a strong recovery in 2022.

Shields said data tracking through its portfolio companies including SiteMinder is showing strong recovering numbers.

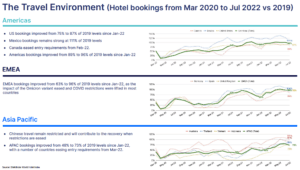

“SiteMinder has established a world hotel index which tracks hotel booking activity globally and is indicating a widespread recovery across the globe,” he said.

“Compared to pre-pandemic levels, the Americas and EMEA are back to just under 100%, while APAC is a little bit lower at 86%, which is very encouraging.”

Source: SiteMinder FY22 results presentation

Shields said the main reason APAC is lower is it includes China and Japan which are yet to fully reopen to travel and tourism.

Chinese tourists are currently restricted from outbound travel but are expected to begin again soon and return to pre-pandemic levels by 2024.

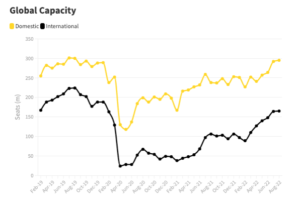

Shields said data from the airlines on flight capacity and daily passenger movements supports what they are seeing in the accommodation booking data, which is they are on a whole trending back to pre-pandemic levels.

Chart: global seat capacity (www.oag.com)

More room to grow

Shields said BTI expects the travel sector to grow further with strong structural tailwinds.

“Domestic activity is leading the recovery at the moment but international is also building and we expect it to come online through the course of the next 12 to 18 months,” he said.

“One of the big drivers of growth will be China, which pre-pandemic recorded approximately 155 million outbound tourists travelling to international destinations.”

Shields said there’s also been an interesting shift by consumers backed by McKinsey & Company research showing in terms of allocation of budget travel is a priority.

“Travel was the top priority in terms of discretionary spending” he said. “It’s quite extraordinary to see research showing travel is more important to people right now than their mortgage, rent or a car.”

He said consumers have entered a period of travel “no-matter what” meaning travel plans have been left largely unchanged despite macroeconomic headwinds of rising inflation and interest rates.

“We think this change in mindset will remain for some time because people are trying to catch up on lost time and take advantage of opportunities while they are here,” he said.

“So, they are strong structural tailwinds which we think will push demand up even further for travel going forward.”

However, Shields said business travel has not returned to pre-pandemic levels.

“There’s a change in behaviour with more working from home style arrangements and meetings via Zoom and other technology,” he said.

“There’s still a lot of room for growth and Deloitte ran a survey showing there will be a significant return to business-based travel over the course of the next year.”

Experiences drive travel sector

Shields said there is a much bigger drive towards consumers spending more of their travel budget on experiences such as in-destination tours and ticketed events.

One of the world’s major tour and activity online agencies Get your Guide released figures showing 40% growth in revenue per customer since 2019 as they book experiences via their platform.

“All those factors are what we are looking at closely to see what the recovery will look like here on out and we feel it’s very positive overall,” Shields said.

Technology will be key in sector

Shields said while it’s great to have a huge surge in demand coming through it must be met with supply, which is where technology comes into play in the travel sector.

“At this point in time a lot of travel providers are benefiting from the huge surge in spending which is helping boost profitability,” he said.

But once peak season is over for the northern hemisphere BTI expects a lot of travel businesses to look at tech alternatives to ensure they capture all the demand to fill their rooms, seats on a tour or plane.

“For example, SiteMinder is the channel manager of choice which allows hotels to get their room inventory out there as far and wide as possible,” he said.

“It’s a similar situation with Rezdy but they are serving the tours and activities space, so a lot of their operators are hiking tours, bridge climbs or jet boat experiences.

“Operators want to capture the booking and make sure that person is catered for in terms of inventory, transfers and all the logistics requirements to undertake the experience.”

Shields said: “So if investors are looking for a way to play the re-emergence of travel, BTI is a good option.”