Stockhead: Bailador fund’s allocation to hotel commerce platform SiteMinder proves a five-star investment

- Bailador’s investment in its largest portfolio holding SiteMinder is looking strong, given the latter’s strong FY25 results and share price action

- SiteMinder’s predictable subscription revenues complemented by new Smart Platform products are driving growth

- SiteMinder outpacing ASX tech peers on ARR growth while trading on lower valuation multiples

Special Report: Tech-centric capital fund Bailador Technology Investments’ (ASX:BTI) large portfolio allocation to SiteMinder has proved a strong move, with the global hotel software platform delivering excellent annual results and a share price up more than 30% over the past month.

SiteMinder (ASX:SDR) is the largest holding in the BTI portfolio, with the platform enabling hotels to manage and distribute room inventory, connect with customers, online travel agents and property systems, take payments and improve guest experience.

BTI co-founder Paul Wilson noted SiteMinder was widely regarded as the world leader in hotel tech, and that it was the world’s most awarded hotel platform, with a presence in more than 150 countries, offering a multilingual platform in eight languages.

“With 50,0000 hotel customers, extensive online travel agent (OTA) and property management system (PMS) connections, global footprint, and industry awards, SiteMinder is positioned at the centre of the hotel room distribution ecosystem,” he said.

Source: BTI

Revenue up more than 27% in FY25

Among the highlights of SiteMinder’s FY25 results, annualised recurring revenue rose 27.2% on a constant currency basis to $273 million, with the growth rate accelerating.

The company added 5,600 new properties, lifting its total to 50,100, and delivered positive free cash flow for the full year.

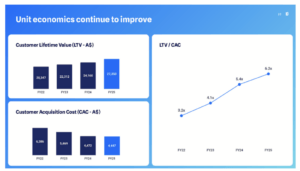

Both underlying EBITDA and free cash flow margins improved, reflecting operating leverage, while customer lifetime value(LTV)/customer acquisition cost (CAC) strengthened from 5.4x in FY24 to 6.2x. Importantly, Wilson said growth was achieved across all regions.

“These are outstanding results. Financial results flow when a company consistently demonstrates good unit economics,” Wilson said.

“SiteMinder has for some time been generating improving lifetime value per customer, while simultaneously reducing the customer acquisition cost.”

Source: BTI

‘Hard for others to catch’

SiteMinder’s traditional revenue model has primarily been fixed fee subscription, with some pricing layers based on hotel size.

“This model provides an extremely predictable and reliable revenue stream, which continues today,” Wilson said.

“Subscription revenue has been growing in the teens percentage per annum, which is commendable.

Together with some faster growing, but lower margin transaction-based revenue, SiteMinder has built a footprint and technology leadership which will be hard for others to catch.”

Launch of Smart Platform to drive rates of growth

In a bid to accelerate growth, SiteMinder unveiled three new products collectively under the banner of the Smart Platform last year, described by Wilson as a potential paradigm shift for the business.

Wilson said Smart Platform had the potential to “drive rates of growth and profitability to substantially higher levels”.

All three products under the Smart Platform have now launched and commenced monetisation, with early results described as encouraging.

Source: BTI

“SiteMinder is entering a period in which its reliability of subscription revenue is ready to combine with potentially exceptional growth, based on the huge volume of platform throughput (> $85 billion of bookings annually) and intelligent use of data available through the platform,” Wilson said.

He said the company’s performance had also caught the attention of analysts, with its strong ARR growth combined with positive and improving free cash flow margins, metrics that outpace many of its ASX-listed tech peers such as WiseTech Global (ASX:WTC), Xero (ASX:XRO) and Technology One (ASX:TNE).

Confident tone in outlook

SiteMinder said it was confident of building on FY25’s growth with further strong ARR and revenue growth in FY26, while continuing to improve underlying EBITDA and free cash flow.

“SiteMinder is focused on scaling growth through Smart Platform adoption, product expansion, and global market penetration,” the company said in its FY25 results announcement.

“The Smart Platform remains early in its adoption and monetisation curve, providing significant long-term potential across SiteMinder’s global footprint.

“As the Smart Platform scales and matures, it positions SiteMinder to accelerate towards 30% revenue growth in the medium term, while maintaining profitability discipline and continued optimisation of Rule of 40 performance.