Stockhead: Tech fund Bailador’s private portfolio returns 24.7pc in H1 FY25

- Bailador Technology Investments reports private portfolio return of 24.7% per annum for H1 FY25

- Technology-focused capital fund increases valuation of several companies held

- Portfolio gain was 11.4 cents per share with strong growth forecast for H2 FY25

Special Report: Tech-centric capital fund Bailador Technology Investments has reported a strong H1 FY25 with its private portfolio return of 24.7% per annum and increasing its valuation of various companies held.

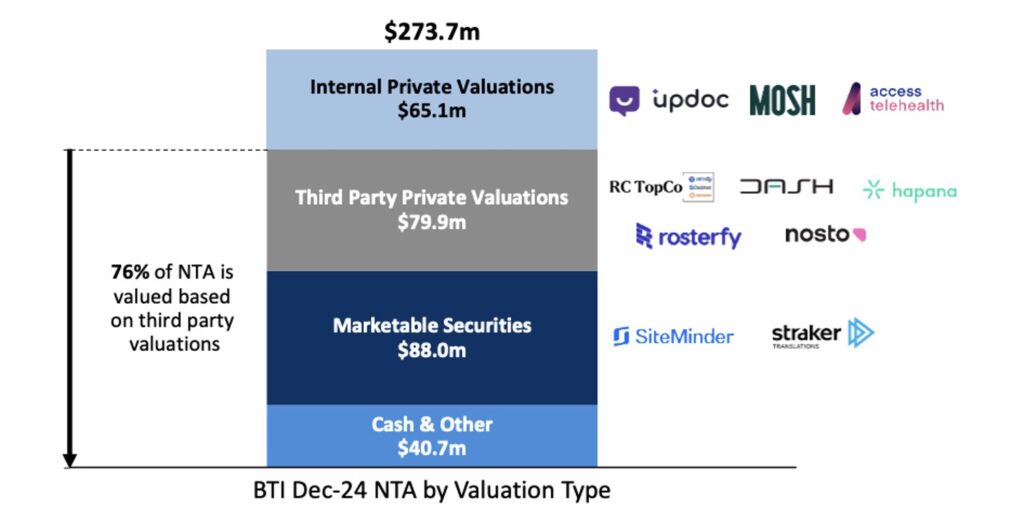

Bailador Technology Investments (ASX:BTI) said its net tangible assets (NTA)/share after all fees (plus net dividends paid) rose by 7.2% in H1 FY25.

BTI said the gain was driven by strong investment performance, with portfolio gains reaching 11.4 cents per share after accounting for expenses. The had a dividend payout of 3.4 cents per share.

Based on this performance, BTI’s published dividend policy implies an interim dividend of 3.7 cents per share, fully franked.

Investment gains for private companies

In their January report, co-founders David Kirk and Paul Wilson noted that during H1 FY25 BTI’s private company investments continued their strong performance returning an internal rate of return (IRR) for the half of 24.7%.

BTI increased the value of its investment in telehealth platform Updoc by 50% to $30 million in December following strong revenue growth and continued profitability.

The company initially invested $20m in Updoc in May 2024 after a successful investment with InstantScripts, with the business scaling rapidly and being sold to Wesfarmers (ASX:WES) in 2023, generating a 61% IRR for BTI.

“We have elected to increase the valuation of Updoc faster than our normal 12-month review cycle due to the material valuation uplift implied by the performance of the business,” Kirk and Wilson said.

“We remain very impressed by the founders and the opportunity.”

BTI also increased the carrying value of Mosh in H1 FY25 by 33%, from $7.5m to $10m, following consistent strong revenue growth and excellent margin management.

Mosh is a digital healthcare service focused on men’s health across the areas of hair loss, weight management, sexual and mental health.

“In addition to strong, consistent revenue growth, Mosh has achieved profitability,” Kirk and Wilson said.

They noted, too, that the carrying value of Rosterfy was increased by 14% in September, making a total increase of 45% since initial investment in April 2023, following a $3 million follow-on investment it provided.

“This was followed by a further $5.5 million investment by another institutional investor in December 2024 at the same valuation,” Wilson and Kirk said.

“Their due diligence and valuation provide a strong third-party endorsement of our carrying value.”

Rosterfy provides volunteer and workforce management software to not-for-profit organisations, government volunteering bodies and mass-scale sporting and other events.

BTI cashes in on SiteMinder share rise

In November BTI sold $20m of its position SiteMinder (ASX:SDR), which amounted to 18% of its position, crystallising gains.

Kirk and Wilson said SDR’s share price increased by 18.7% during H1, after trading significantly higher for much of the period with its gain for the period 20.8%.

The fund was an early investor in the hotels booking platform and said SDR remained a core holding for it for the foreseeable future.

The sale at $6.65 per share was only 4% off the 12-month high to December 2024 and represented 30.6% above the June 30 share price.

BTI also revealed its investment in artificial intelligence play Straker, which provides automated language translation services with human translators to check for accuracy, increased in value 17.5% in H1 FY25.

Investment in new companies

Along with increasing its investment in Rosterfy, BTI ramped up its investment in other holdings during H1 FY25 as well as bringing in new portfolio companies.

In August 2024 BTI invested $7.7m in high-growth fitness studio management software platform Hapana.

“Hapana has performed strongly in the four months since our investment, and we remain very positive on the investment,” Wilson and Kirk said.

In October BTI announced a follow-on investment in fintech Dash, consisting of $5m of equity and $5m of debt to fund the acquisition of complementary portfolio administration business IPS.

BTI said the acquisition increased Dash’s funds under administration from $4.5 to $15 billion and added an excellent offering for high and very high net wealth clients.

In December the company also added $1.1m as follow-on investment in Access Telehealth, alongside other existing institutional investors.

Portfolio composition at end of H1 FY25

BTI said it now holds 14.9% as net cash, 32.2% is invested in publicly listed companies and of the 53% invested in private companies, 29.2% is valued by third-party transactions, leaving just 23.8% as internal valuations.

Kirk and Wilson said there had never been a third-party transaction in the history of the fund at a lower value than its holding value at the time, and that its average valuation uplift on realisation is 39%.

“Barring a severe negative change in market conditions, which we do not expect, we feel confident we are set to deliver strong investment returns for investors in the coming months and years,” they said.

“We continue to be focused on a balance of growth, path to future profitability and return on initial and incremental capital invested.

“This focus is reflected in our portfolio metrics.

“For the portfolio as a whole revenue growth continues to be strong at 41% and our portfolio gross margin is consistently strong at 66%.”

Source: BTI