Simply Wall St Bailador Analysis

By Joel Foster via simplywall.st

How Does Bailador Technology Investments Limited (ASX:BTI) Affect Your Portfolio Returns?

If you are a shareholder in Bailador Technology Investments Limited’s (ASX:BTI), or are thinking about investing in the company, knowing how it contributes to the risk and reward profile of your portfolio is important. Broadly speaking, there are two types of risk you should consider when investing in stocks such as BTI. The first risk to think about is company-specific, which can be diversified away by investing in other companies in order to lower your exposure to one particular stock. The second type is market risk, one that you cannot diversify away, since it arises from macroeconomic factors which directly affects all the stocks in the market.

Different characteristics of a stock expose it to various levels of market risk. A popular measure of market risk for a stock is its beta, and the market as a whole represents a beta value of one. A stock with a beta greater than one is considered more sensitive to market-wide shocks compared to a stock that trades below the value of one.

An interpretation of BTI’s beta

Bailador Technology Investments’s beta of 0.16 indicates that the stock value will be less variable compared to the whole stock market. The stock will exhibit muted movements in both the downside and upside, in response to changing economic conditions, whereas the general market may move by a lot more. BTI’s beta implies it may be a stock that investors with high-beta portfolios might find relevant if they wanted to reduce their exposure to market risk, especially during times of downturns.

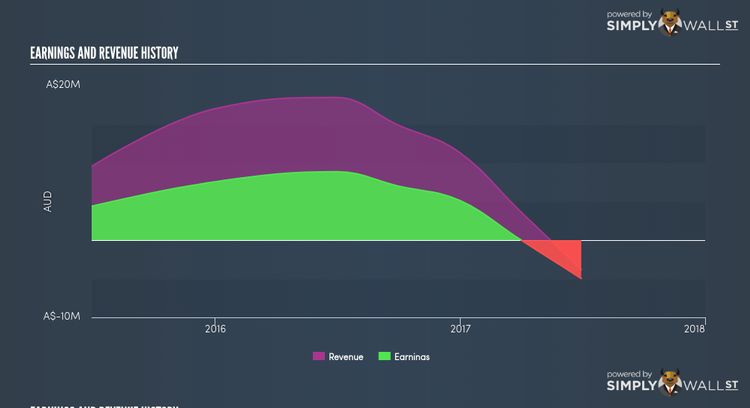

ASX:BTI Income Statement Nov 28th 17

Could BTI’s size and industry cause it to be more volatile?

With a market cap of AUD A$108.22M, BTI falls within the small-cap spectrum of stocks, which are found to experience higher relative risk compared to larger companies. In addition to size, BTI also operates in the capital markets industry, which has commonly demonstrated strong reactions to market-wide shocks. Therefore, investors may expect high beta associated with small companies, as well as those operating in the capital markets industry, relative to those more well-established firms in a more defensive industry. This is an interesting conclusion, since both BTI’s size and industry indicates the stock should have a higher beta than it currently has.

Is BTI’s cost structure indicative of a high beta?

During times of economic downturn, low demand may cause companies to readjust production of their goods and services. It is more difficult for companies to lower their cost, if the majority of these costs are generated by fixed assets. Therefore, this is a type of risk which is associated with higher beta. I test BTI’s ratio of fixed assets to total assets in order to determine how high the risk is associated with this type of constraint. Considering fixed assets is virtually non-existent in BTI’s operations, it has low dependency on fixed costs to generate revenue. Thus, we can expect BTI to be more stable in the face of market movements, relative to its peers of similar size but with a higher portion of fixed assets on their books. This is consistent with is current beta value which also indicates low volatility.

What this means for you:

Are you a shareholder? You could benefit from lower risk during times of economic decline by holding onto BTI. Take into account your portfolio sensitivity to the market before you invest in the stock, as well as where we are in the current economic cycle. Depending on the composition of your portfolio, BTI may be a valuable stock to hold onto in order to cushion the impact of a downturn.

Are you a potential investor? Depending on the composition of your portfolio, BTI may be a valuable addition to cushion the impact of a downturn. Potential investors should look into its fundamental factors such as its current valuation and financial health. Take into account your portfolio sensitivity to the market before you invest in BTI, as well as where we are in the current economic cycle.

Beta is one aspect of your portfolio construction to consider when holding or entering into a stock. But it is certainly not the only factor.