Tech unicorns: will they keep soaring or are valuations fantasy?

via afr.com

By Tony Featherstone

The rise of billion-dollar software stocks is forcing investors to decide if a new generation of tech unicorns will keep soaring or if their valuations are fantasy.

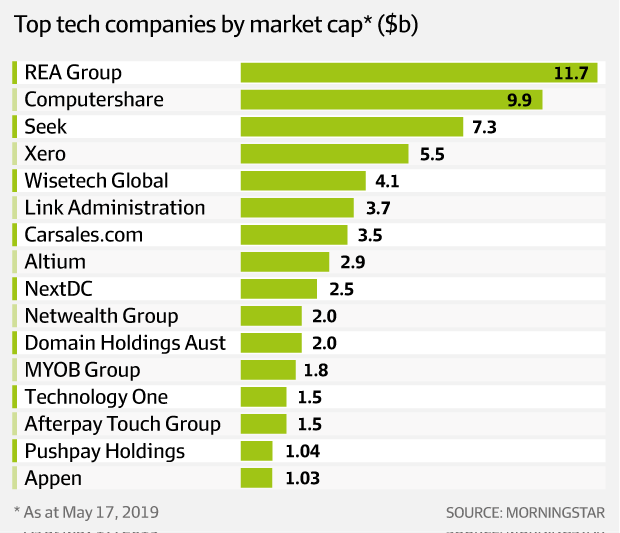

The tech-listings boom is spawning stars. There are 17 tech unicorns – an industry term used to describe tech companies with valuations above $1 billion – on the Australian Securities Exchange.

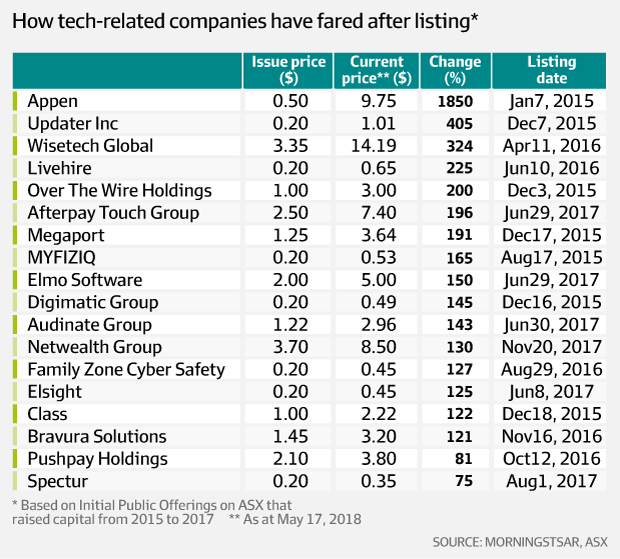

WiseTech Global, Pushpay Holdings and several other software-as-a-service stocks have more than doubled since listing. Language technology provider Appen has jumped almost twentyfold.

Financial-technology listings have rallied. Lay-by innovator Afterpay Touch Group and investment products platform Netwealth Group have added more than $1 billion of value in less than 12 months as investors embrace fintech.

"Recent gains in Australian tech are years in the making," says David Kirk, managing director of listed investment company Bailador Technology Investments. "Our tech ecosystem has grown rapidly and there is greater capital available for promising ideas. The result is more tech companies getting to a size where they can list on ASX and, generally, being better quality when they get there."

Investors are paying huge prices for tech stocks that can lead their market. Logistics software provider WiseTech, for example, is on a forward price-earnings (P/E) of 100 times, using consensus analyst forecasts. That is more than double the P/E multiple of online marketplace star REA Group.

P/E multiples for WiseTech and other tech stars fall sharply in future years, assuming their growth rates continue. Also, earnings-based metrics, such as P/E multiples, are simplistic because tech stars often reinvest most or all their profit to grow.

Still, most tech unicorns have nose-bleeding valuations and little room for error. WiseTech shares, for example, tumbled after its interim result in February was below market expectation, despite revenue leaping 31 per cent.

Stretched valuations

Julian Beaumont, investment director of Bennelong Australian Equity Partners, says the local tech sector is mostly expensive. "Valuations are stretched. The big software-as-a-service stocks can be great businesses, but valuations often factor in faultless execution and exceptionally strong growth," he says. "Investors are taking a lot of risk buying tech stars at current prices. These stocks can fall a long way if something goes wrong or growth does not meet the market's high expectations."

Beaumont says a shortage of large Australian tech stocks is creating concentration risk.

"Fund managers like tech companies because they are scalable and so have attractive growth runways. But there is only a small number of solid tech stocks to choose from on the ASX and it seems many [investors] are crowding into these names. That is pushing up valuations. There's not enough supply of quality tech to satisfy market appetite."

Extra supply is coming. Tech stocks are dominating the initial public offering (IPO) pipeline, by volume. More than 80 floats have raised a combined $3.5 billion since 2013, ASX data shows. There have been more tech listings on the ASX than on Nasdaq in the past few years – albeit smaller, such is the interest in Australian tech.

Dozens of other tech companies have joined the ASX through reverse takeovers, where tech companies buy assets or shares of dormant listed entities. These backdoor listings tend to be smaller and more speculative; many have disappointed investors.

IPO results are mixed. Roughly a third of tech floats since 2015 have produced gains of 30 per cent or more compared to their issue price, analysis by The Australian Financial Review shows. Many have sunk below their offer price at the float.

The spike in tech IPOs has made the sector second only to mining, by company volume, on the ASX. There are more than 220 tech companies across software, hardware, fintech and online marketplaces (such as Seek) – and others still if technology definitions are broadened.

That is a remarkable turnaround for a market that for decades has been dominated by banking and mining and offered barely any tech exposure. Australian investors have typically looked overseas to buy large tech stocks directly or invest in specialist tech funds.

CLICK HERE to read the full article at The Australian Financial Review.