Stockhead: BTI reports a strong FY24 and says there is a growing pipeline of opportunities for FY25. Pic: Getty Images Tech fund Bailador reports strong FY24 and declares fully franked dividend

- Tech-focused capital fund Bailador reports NPAT of $20.7m for FY24, up 282% on FY23

- Final dividend of 3.4 cents/share declared, representing grossed-up annualised yield of 7.8%

- Company deploys $53m including three new portfolio companies after selling InstantScripts for $52m in June 2023

Special Report: Capital fund Bailador Technology Investments has reported its FY24 results including NPAT of $20.7m, up 282% on pcp and a final dividend declared of 3.4 cents/share fully franked representing an annualised yield of 7.8% when grossed-up for franking credits.

Bailador Technology Investments (ASX:BTI) has recorded a strong FY24 with deployment of capital to new and existing companies, cash back to target levels, dividend stability, robust operating performance of its portfolio and conservatively valued investments with valuation upside potential.

Among highlights of FY24 include:

- Net profit after tax (NPAT) of $20.7m, up 282% on prior year

- Final dividend declared of 3.4 cents/share fully franked, which represents an annualised grossed-up yield of 7.8%

- Net tangible asset (NTA) per share (post-tax) up 7 cents over prior year to $1.59, up 14 cents after adding back dividends paid during the period

- $53m in cash deployed and committed including three new portfolio companies (Updoc, DASH Technologies and Hapana)

- Dividend reinvestment plan (DRP) active with a 2.5% discount

- $52m net cash as at July 31, 2024, to take advantage of additional investment opportunities

Growing portfolio

BTI invests in tech-focused businesses in Australia and New Zealand that require growth capital.

In particular, the company focuses on software, internet, mobile, data and online marketplaces with proven revenue generation and management capability, demonstrated business models and expansion opportunities.

BTI now has a portfolio of 10 companies and the company says it ended FY24 in a strong position with combined portfolio revenue of $457m and revenue growth of 47% over the past 12 months.

In July 2023, BTI sold InstantScripts (online scripts, telehealth consultations and prescription medication delivered to homes) to API, a wholly owned subsidiary of Wesfarmers.

“Our returns were outstanding – a 25% uplift on carrying value at the time, $52 million in cash and a 61% IRR,” BTI co-founders David Kirk and Paul Wilson noted in the BTI annual report letter to investors.

“The sale of InstantScripts early in the year took our cash balance to $109m and it took us until the last two months of the year to deploy a decent amount of our large cash balance.

“We make no apologies for being highly selective in deploying our cash reserves.”

Kirk and Wilson also emphasised that it’s important to invest in companies with the right growth economics, which can make a significant difference to investment returns.

“Our aim is to build and manage a portfolio of between eight and 12 companies at any one time, and for each of these companies to deliver excellent investment returns over time,” the founders noted.

BTI says $53m in cash was deployed and committed over the past 12 months with the majority to new investments including:

- Updoc – May 2024, $20m

- DASH Technologies – June 2024, $15m plus $5m additional funding committed

- Hapana – August 2024 – $7.7m

Updoc is a digital healthcare platform that connects consumers who need medical services with registered health practitioners via a telehealth offering.

DASH is a cloud-based financial advice and investment management software platform used by Independent Financial Advisors (IFAs) and financial institutions.

Hapana is an end-to-end software platform for gyms and boutique fitness studios.

Strong portfolio return in FY24

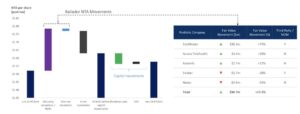

BTI delivered a portfolio return of 9.2% in FY24, after all fees and taxes. The company says post-tax NTA per share growth was driven by valuation increases to SiteMinder (ASX:SDR), Access Telehealth and Rosterfy.

There was a modest recorded increase to private company valuations despite strong operating and financial performance, which BTI says was consistent with its conservative approach to valuation.

The company says there is significant valuation upside potential to its portfolio companies.

Source: BTI

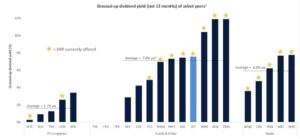

Attractive dividend yield vs peers

BTI has declared a final dividend of 3.4 cents/share, which represents an annualised yield of 5.8% (or 7.8% when grossed up for franking credits) based on the closing price of BTI shares on August 13, 2024.

BTI says the dividend is part of its ongoing commitment to pay regular dividends to shareholders totalling 4% of pre-tax NTA per annum. Over the past three years, Bailador has paid a total of 22.4c per share in fully-franked dividends at an average annualised grossed-up yield of 7.7% per annum.

The company established a dividend reinvestment plan (DRP) in February 2020 and operates in respect of the declared dividend.

BTI says the DRP price has been determined by the board of directors to be a 2.5% discount to the volume weighted average price (VWAP) over the four trading days from August 19-22, 2024.

All Bailador shareholders who have a registered address in Australia or New Zealand are eligible to participate in the DRP for shares held on the relevant dividend record date of August 20.

Source: BTI

BTI says its dividend yield is looking attractive compared to peers.

Source: BTI

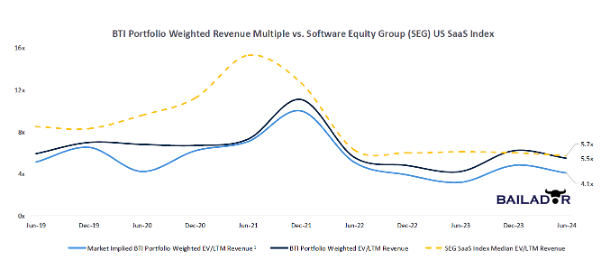

Conservatively valued portfolio

Bailador has maintained a disciplined approach to valuing its portfolio companies, as demonstrated by comparing its portfolio weighted revenue multiple to the market over time:

Source: BTI

The BTI portfolio weighted EV/LTM Revenue multiple is 5.5x versus a ‘market multiple’ benchmark of 5.7x. However, Bailador’s portfolio weighted valuation drops to approximately 4.1x when factoring in the NTA per share discount that BTI shares are currently trading at. This further enhances the prospect of material valuation upside from within the Bailador portfolio.

“We feel comfortable that we are holding our portfolio of private investments at conservative valuations, and that our public company positions are well understood, providing significant upside potential,” Wilson said

Growing opportunities in FY25

With a strong cash balance, BTI says there is a growing pipeline of opportunities ahead for the company.

“We look forward to continuing to deploy available capital to new and existing portfolio companies and delivering strong investment returns to investors in the year ahead,” Wilson says.